All Categories

Featured

Table of Contents

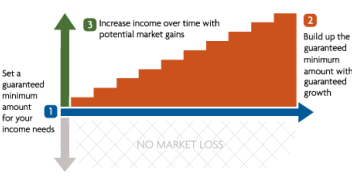

These functions can vary from company-to-company, so be certain to discover your annuity's fatality advantage features. There are several benefits. 1. A MYGA can mean lower taxes than a CD. With a CD, the rate of interest you make is taxed when you gain it, although you do not receive it up until the CD grows.

At the really the very least, you pay taxes later on, instead than faster. Not only that, yet the worsening interest will be based upon an amount that has not already been tired. 2. Your recipients will certainly get the full account value since the date you dieand no surrender charges will be subtracted.

Your beneficiaries can choose either to obtain the payout in a swelling sum, or in a collection of earnings settlements. 3. Usually, when somebody dies, even if he left a will, a judge chooses who gets what from the estate as occasionally loved ones will say regarding what the will methods.

It can be a long, complicated, and very pricey process. People go to excellent sizes to avoid it. With a multi-year fixed annuity, the owner has actually clearly marked a recipient, so no probate is needed. The cash goes directly to the recipient, no inquiries asked. is annuity insurance. If you add to an individual retirement account or a 401(k) strategy, you receive tax obligation deferment on the incomes, similar to a MYGA.

Tax Deferred Annuity Withdrawal

If you are younger, invest just the funds you will not require till after age 59 1/2. These could be 401(k) rollovers or cash you hold in individual retirement account accounts. Those products already offer tax obligation deferral. MYGAs are wonderful for people who want to avoid the risks of market changes, and desire a dealt with return and tax obligation deferment.

The insurance company spends it, typically in high top quality lasting bonds, to money your future payments under the annuity. Bear in mind, the insurance company is relying not just on your private repayment to money your annuity.

These payments are constructed into the acquisition cost, so there are no covert charges in the MYGA contract. Actually, deferred annuities do not charge fees of any type of kind, or sales costs either. Certain. In the current environment of low rate of interest rates, some MYGA financiers construct "ladders." That means purchasing multiple annuities with staggered terms.

Best Fixed Rate Annuities

For example, if you opened MYGAs of 3-, 4-, 5- and 6-year terms, you would have an account growing yearly after 3 years. At the end of the term, your cash might be withdrawn or put into a new annuity-- with good luck, at a greater rate. You can additionally utilize MYGAs in ladders with fixed-indexed annuities, a method that looks for to make the most of yield while likewise protecting principal

As you contrast and comparison illustrations supplied by various insurance companies, take into factor to consider each of the locations provided above when making your last choice. Understanding agreement terms along with each annuity's benefits and drawbacks will certainly allow you to make the finest decision for your economic circumstance. Think meticulously regarding the term.

What Is An Annuity Surrender Charge

If passion prices have risen, you may want to secure them in for a longer term. Throughout this time, you can obtain all of your money back.

The company you buy your multi-year guaranteed annuity via accepts pay you a fixed rate of interest on your premium amount for your selected period. You'll obtain rate of interest attributed often, and at the end of the term, you either can renew your annuity at an updated rate, leave the money at a fixed account rate, choose a negotiation option, or withdraw your funds.

What Is The Best Variable Annuity

Considering that a MYGA provides a set passion price that's guaranteed for the contract's term, it can offer you with a predictable return. With prices that are established by agreement for a certain number of years, MYGAs aren't subject to market changes like various other financial investments.

Minimal liquidity. Annuities typically have charges for early withdrawal or abandonment, which can restrict your ability to access your cash without charges. Lower returns than other financial investments. MYGAs might have lower returns than stocks or mutual funds, which might have higher returns over the lengthy term. Costs and expenditures. Annuities usually have surrender charges and administrative prices.

MVA is an adjustmenteither positive or negativeto the gathered worth if you make a partial surrender over the totally free amount or fully surrender your contract during the surrender cost duration. Rising cost of living threat. Because MYGAs use a fixed rate of return, they may not equal rising cost of living gradually. Not insured by FDIC.

5 Million Dollar Annuity

It is essential to vet the toughness and security of the company you pick. Take a look at reports from A.M. Finest, Fitch, Moody's or Requirement & Poor's. MYGA rates can transform commonly based upon the economic situation, however they're generally more than what you would make on an interest-bearing account. The 4 sorts of annuities: Which is right for you? Required a refresher course on the four fundamental kinds of annuities? Learn much more just how annuities can assure an earnings in retired life that you can not outlive.

If your MYGA has market price adjustment stipulation and you make a withdrawal before the term mores than, the company can change the MYGA's abandonment worth based on modifications in interest rates - what age can i buy an annuity. If rates have actually raised given that you acquired the annuity, your abandonment worth may decrease to make up the greater rate of interest rate setting

Not all MYGAs have an MVA or an ROP. At the end of the MYGA period you've chosen, you have three alternatives: If having actually an assured passion price for a set number of years still lines up with your financial technique, you merely can renew for an additional MYGA term, either the very same or a various one (if offered).

With some MYGAs, if you're unsure what to do with the cash at the term's end, you do not have to do anything. The accumulated value of your MYGA will certainly move into a dealt with account with a sustainable 1 year rates of interest established by the firm - where are premiums from fixed annuities invested. You can leave it there until you pick your following step

While both offer guaranteed prices of return, MYGAs commonly offer a higher rate of interest rate than CDs. MYGAs expand tax deferred while CDs are exhausted as earnings every year. Annuities grow tax deferred, so you do not owe earnings tax on the earnings till you withdraw them. This enables your earnings to worsen over the term of your MYGA.

With MYGAs, abandonment costs may use, depending on the type of MYGA you choose. You may not just lose rate of interest, yet also principalthe cash you originally added to the MYGA.

Retirement Annuities

This implies you may weary but not the primary amount added to the CD.Their traditional nature commonly allures a lot more to individuals that are approaching or currently in retired life. But they may not be appropriate for everybody. A may be best for you if you wish to: Make use of an assured price and secure it in for a time period.

Gain from tax-deferred profits development. Have the option to select a negotiation choice for an ensured stream of income that can last as long as you live. Similar to any type of kind of savings vehicle, it is essential to very carefully review the terms of the product and seek advice from to figure out if it's a sensible selection for accomplishing your individual requirements and goals.

1All guarantees consisting of the survivor benefit payments are dependent upon the insurance claims paying ability of the issuing business and do not use to the financial investment performance of the hidden funds in the variable annuity. Assets in the underlying funds are subject to market threats and might rise and fall in value. Variable annuities and their underlying variable financial investment choices are offered by syllabus just.

What Is Annuities Explained

This and other information are included in the syllabus or recap program, if offered, which may be obtained from your financial investment expert. Please review it before you invest or send cash. 2 Scores are subject to alter and do not relate to the underlying financial investment choices of variable products. 3 Present tax obligation law undergoes interpretation and legal modification.

Entities or persons distributing this info are not accredited to give tax obligation or legal recommendations. Individuals are urged to seek specific guidance from their individual tax obligation or lawful advice. 4 , Just How Much Do Annuities Pay? 2023This product is intended for public use. By supplying this content, The Guardian Life Insurance Policy Company of America, The Guardian Insurance Policy & Annuity Firm, Inc .

Table of Contents

Latest Posts

Breaking Down Pros And Cons Of Fixed Annuity And Variable Annuity Key Insights on Fixed Index Annuity Vs Variable Annuity Defining Fixed Annuity Vs Variable Annuity Advantages and Disadvantages of Fix

Exploring the Basics of Retirement Options A Comprehensive Guide to Investment Choices Defining the Right Financial Strategy Benefits of Choosing the Right Financial Plan Why Choosing the Right Financ

Analyzing Strategic Retirement Planning A Comprehensive Guide to Fixed Vs Variable Annuity Pros And Cons Breaking Down the Basics of Tax Benefits Of Fixed Vs Variable Annuities Features of Annuities V

More

Latest Posts